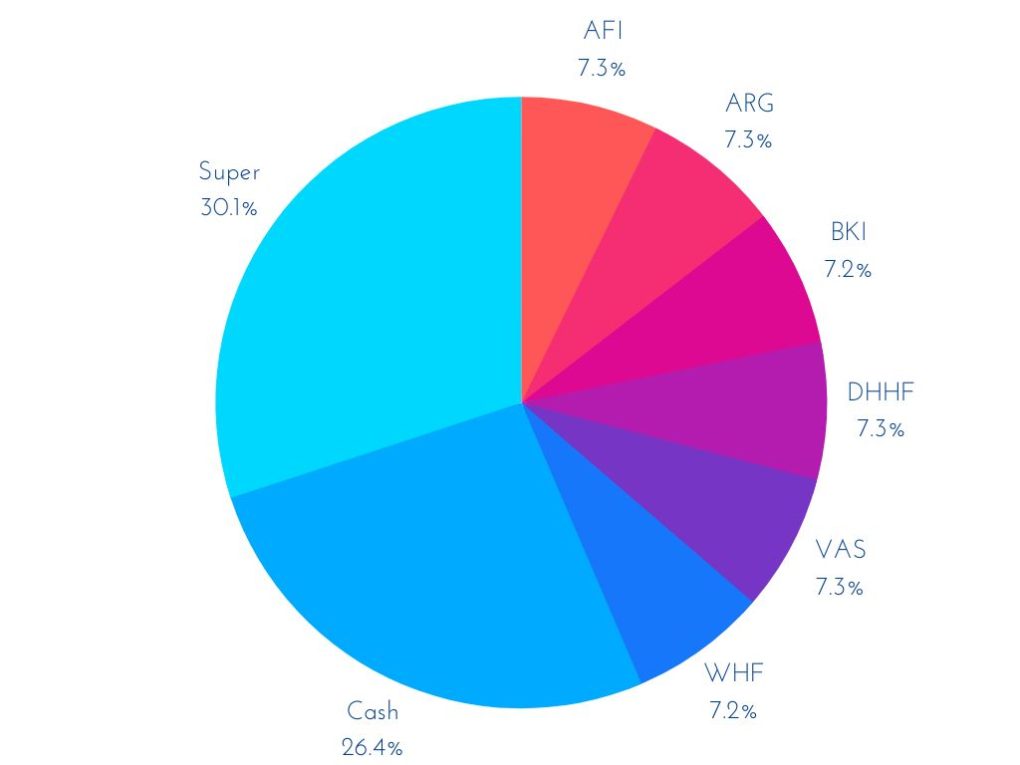

FireStraya Portfolio Update November 2022

My latest portfolio update 5 months into my mini/semi retirement! I used some excess cash this month to re weight my portfolio of LIC’s and ETF’s back to roughly even. I will probably get a lot of criticism for this FIRE portfolio, questions like why so many holdings, why not just DHHF? You have so much overlap etc! I know, I know, some FIRE addicts love to obsess over percentages and getting the optimum returns, I’m more in the camp of you know what these are all great choices so this will probably be good enough for me.

I like the Thornhill approach to LIC’s (the two Aussie Fire Bug podcasts with him are great) but also understand ETF’s are great tools as well. I prefer having more smaller holdings because after having experienced going from being paid weekly to monthly, I realized I much prefer to get more smaller payments than 1 large lump payment. I also plan on never selling any shares, using dividends and part time work to semi retire my way through life, and leaving whatever I accumulate to family and charity when I die. I by no way recommend this portfolio balancing to anyone chasing early retirement in Australia as you are probably statistically better off just using 2 or 3 ETF’s.

My super is indexed using 50% Australian equities and 50% international equities. Going forward, I will probably put more money into VAS and DHHF and less into the LIC’s as they are nearly all trading at a premium to NTA.

I am also holding a lot more cash than I would usually hold. The reason for this is I am currently travelling in Europe and as such not earning anything. This cash buffer gives the safety of not having to work for the foreseeable future and covering all my travels and expenses for quite some time. It is currently in a high interest savings account earning 4.3% which isn’t too bad!