The benefits of a core satellite portfolio

If you are like me, than you are fascinated by all things finance. Since a very young age I’ve consumed more financial media be it books, newspapers or research than pretty much all other subjects I am interested in combined. For your every day person though, the thought of investing could be extremely boring and dull, but for a lucky few, our passions can not only provide us hours of entertainment but also financial gain. This article sums up why I have moved away from 100% passive investing in index funds and LIC’s, to something that is called a core satellite portfolio.

What is a core satellite portfolio?

A core satellite portfolio or strategy is essentially a portfolio that is made up of a core of passive broad assets like bonds, index funds or LIC’s, with a smaller portion of the portfolio geared to higher risk investments. You may already be investing in a version of a core satellite portfolio if for instance you have money invested in VDHG or DHHF, which comprise a mix of different risk/growth indices in them.

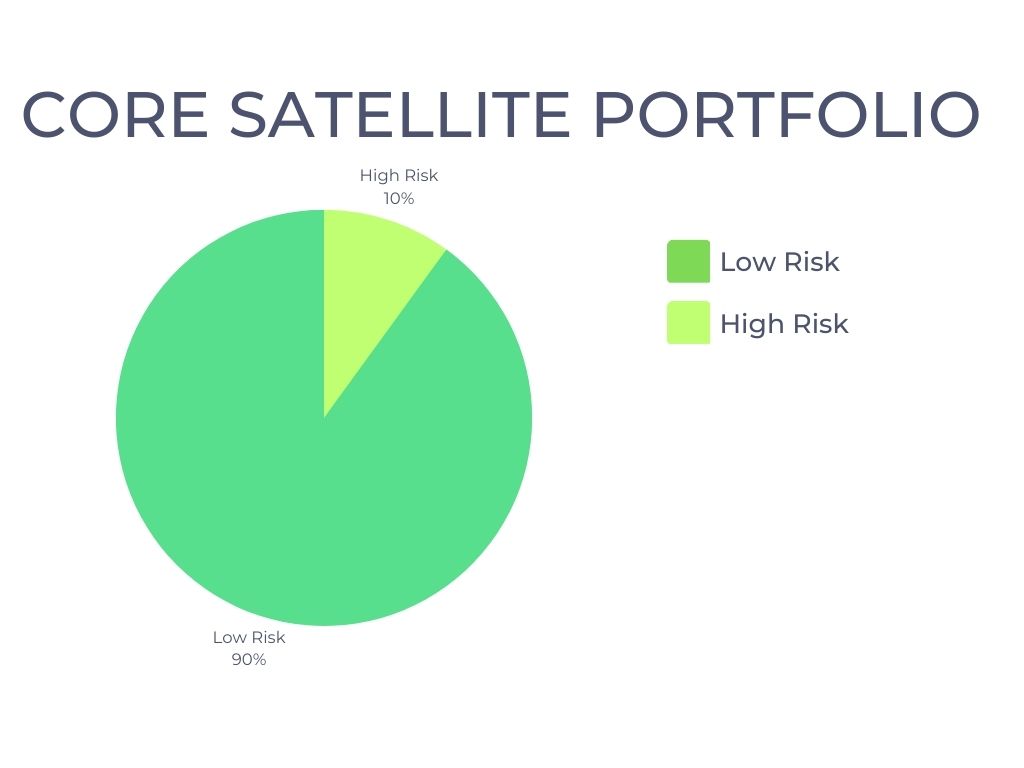

The beauty of the concept is that you enjoy the stability of returns with the core of your portfolio, while maximizing the potential for growth with the rest. The percentage you structure it is entirely up to you, for instance at the current valuations, 90% of my portfolio is in passive index and LIC’s while 10% is comprised of individual small cap shares.

Isn’t trying to pick stocks a bad idea?

Theoretically, yes! The chances of picking a stock or trying to beat the market is extremely slim. There are countless things working against you such as institutional investors with much more resources and information available and super computers trading on algorithms. But hang on a minute, if it’s such a bad idea, then why do it at all? The reason stems down to the pure enjoyment out of researching companies. I love reading up on and nerding out on companies and industries that pique my interest and engaging with others in the space on places like twitter.

After living in Norway for nearly a year, I’ve been totally converted to the green energy movement after witnessing a country with a ridiculous amount of electric and hybrid vehicles. These cars need a huge amount of precious metals and Australia just happens to have a massive amount of that buried somewhere in the outback. Rare earths is a segment in particular that I am especially interested and also green hydrogen but less so as the commercial viability is still yet to be proven. Did you know there can be up to two tonnes of rare earths used in a single wind turbine? After travelling across Europe and seeing these all over the place, and witnessing the world trying to move from fossil fuels to renewables, I’m betting we are going to see a lot more wind turbines!

I like sticking to the smaller end of the small caps, with small markets caps which cut out the competition against bigger investment firms. They can’t buy positions in these companies without pumping up the price because of the low volumes and liquidity (this should be noted is also a risk associated with smaller cap companies). It’s basically, you and a few other punters and average investors trying to find the next big thing.

Think of it like a hobby

The way I justify the irrational behavior of picking individual stocks when I know it to be a statistically stupid thing to do, is to think of it like a hobby. I spent countless hours reading, researching and following companies and industries, and I get a huge amount of enjoyment out of it. Say I was to be really into cycling or fishing or golf, I’ve got to out and buy all the gear and equipment which would provide the same amount of enjoyment, so I see the purchase of these shares as an initial outlay to a hobby I really enjoy. Not only that, but hitting a winner would be like catching the Million Dollar Barra!

You can choose what to invest in

Before I stopped drinking, I used to be really into single malt scotch whisky. I would constantly read up on my favourite distilleries and limited releases and obviously enjoy them in the process. Along the way I would buy a few bottles of each release, enjoy 1 and stash away the others. The plan wasn’t always to sell them, as it’s quite a hassle in Australia with our liquor laws and you have to go through an auction house which take a big chunk of commission, but 9/10 of all of the bottles I have bought have outpaced my returns on all my other investments. One bottle in particular, a 27 year old bottle of Port Ellen, one of Scotlands famous closed down distilleries, was purchased in 2012 from a liquor specialist in Melbourne for $400 AUD, are now selling at auction for around $5000-$6000. That’s a 75% return on investment, each year! I don’t include these in my net worth calculations as I figure I will either auction them for charity one day or give them as wedding presents or something but you can see how you can turn something you are passionate about into something that can also help you towards financial independence.

The chances are you have a hobby which also can be made a part of your satellite portfolio. When I was growing up, Pokémon cards where all the rage, my siblings and I collected hundreds of them. Before I left for Europe I was doing a clean up and I found a whole stash of them, I never got around to seeing what they were worth but I would wager they’re worth a lot more than we paid for them!

Your “play” money side of your satellite portfolio is entirely up to you, pick something you genuinely enjoy researching and learning about because you need to be comfortable that whatever you invest in might not always go up. It might be crypto, gold or silver bullion, collectable cars or speculative listed stocks like me, the choices are endless.

Get the balance right

It’s important to remember that the satellite portfolio is built around a core of safe, low risk assets, so I want to reiterate that the bulk of my money is tied up in everyday broadly diversified ETF’s and LIC’s, and that the portion I am investing in the play money side of my portfolio is relatively small and it wouldn’t really change my financial situation if they all went to zero, however some of the gains that can be made in the space are not to be ignored! After years of idly watching my ETF’s and LIC’s grow with dividends being reinvested, I’ve finally found a perfect balance between getting to enjoy something that I love doing, and still making financially responsible decisions along the way. If you are young like me, then your risk tolerance should be relatively high so I encourage you to do some more research on the core satellite portfolio to see if it could also suit you.

Great article! Really good point on the small caps. If there is value it is going to be down that end, where the big players don’t bother going.

How have you found analysing mining stocks? I always find there is a lot of “promotion” and difficult to seperate value from hype.

Thanks mate appreciate it! You are right especially on the ASX there are a lot of companies that look like they will be the next big thing but in reality few ever get to the production stage. The biggest thing for me was learning how to read drill hole reports and looking for management which have skin in the game and proven track records.

The way I went about it was choosing commodities which I think will be in demand in the future, then finding companies which have hit those in commercially viable numbers. I try to steer clear of “nearology” plays, basically listed companies riding on the back of other players who have hit big close by, and wait until I see them prove deposits. I figure if invest in companies with proven substantial deposits, even if they don’t get a mine up and running another player will probably acquire those tenements as their own ore reserves deplete.

Also steer clear of hotcopper! While there are a few guys on there who know what they are talking about, most people are crippled by the endowment effect, which we are all prone to but seeing other people reinforce your own beliefs can hinder you from making rational decisions if companies change direction.